Solvency II Capital requirements" of collective investment funds: an Overview | Deloitte Luxembourg | Investment Management

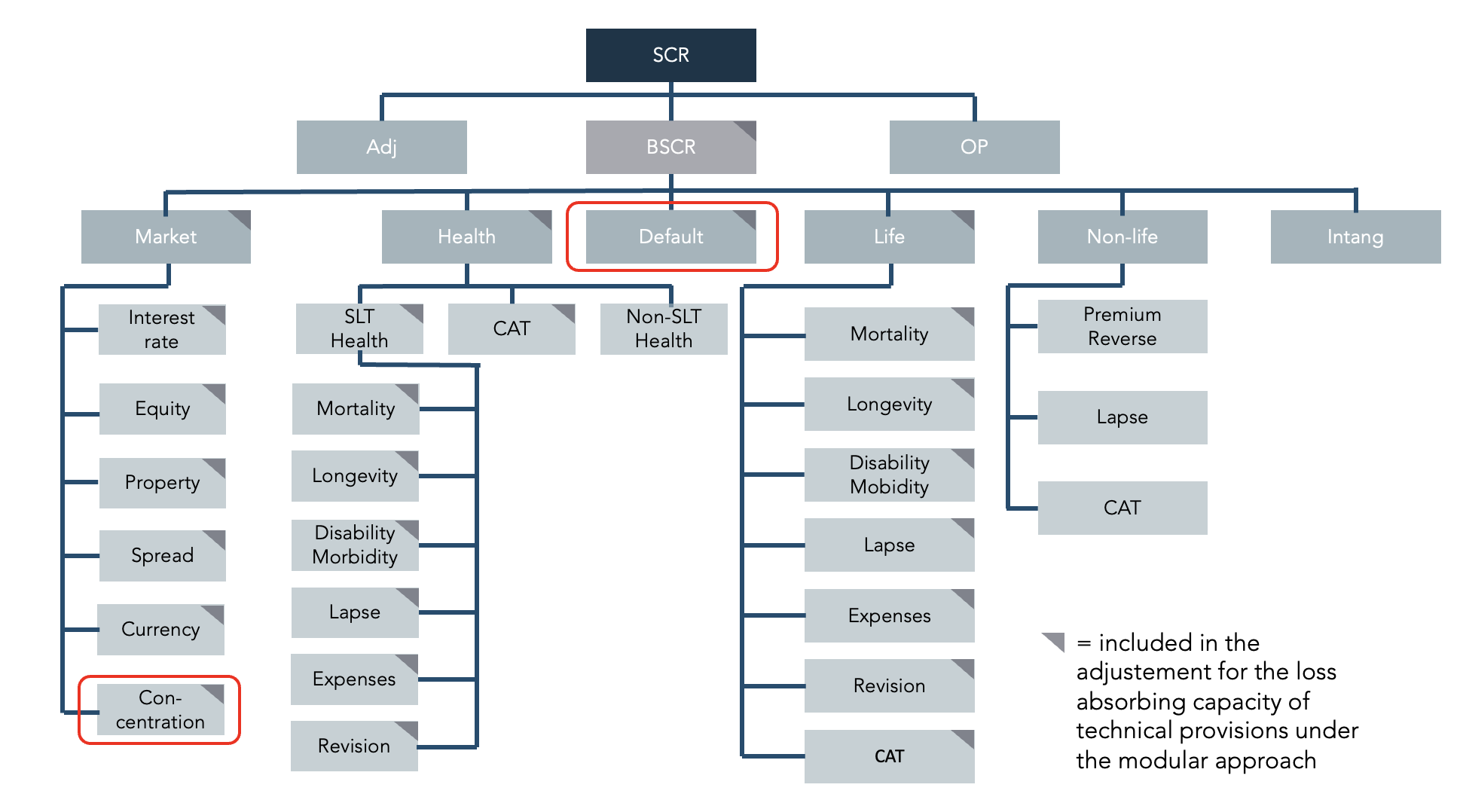

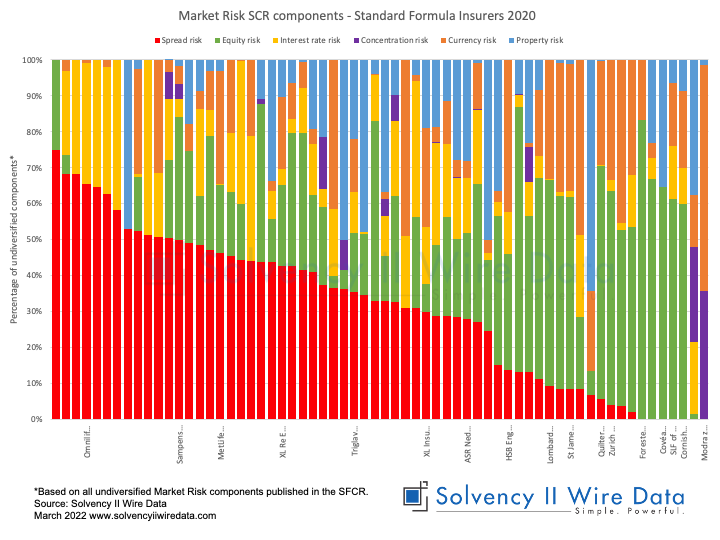

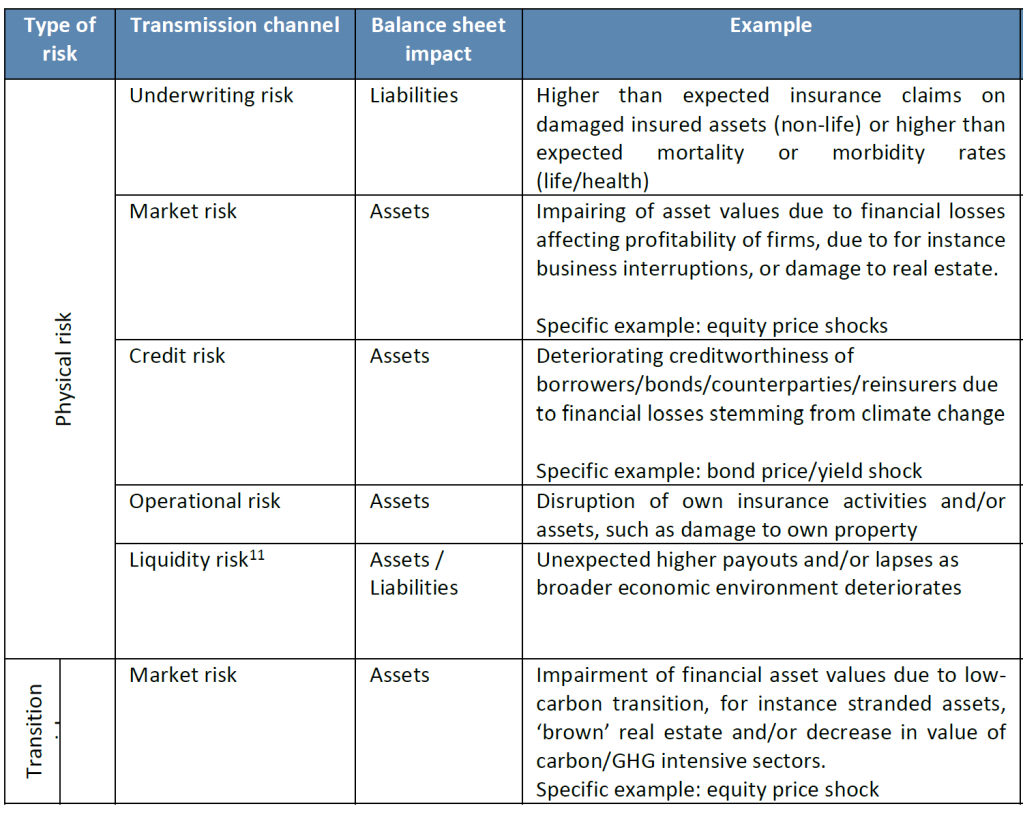

Quantifying credit and market risk under Solvency II: Standard approach versus internal model - ScienceDirect

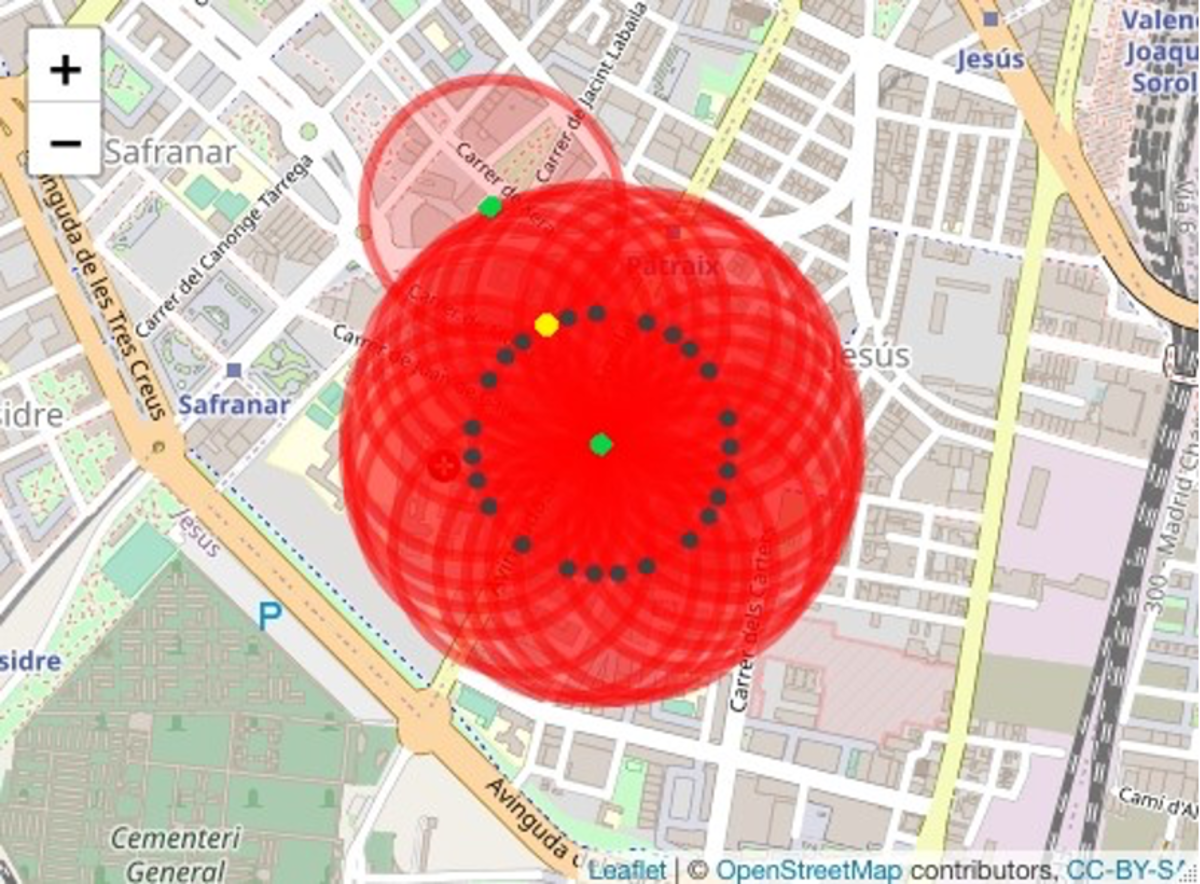

Mathematics | Free Full-Text | Fire Risk Sub-Module Assessment under Solvency II. Calculating the Highest Risk Exposure

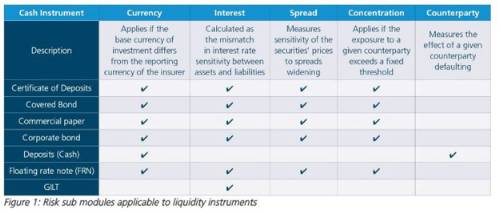

Solvency II Capital requirements" of collective investment funds: an Overview | Deloitte Luxembourg | Investment Management